Adler Group: What investors need to know in connection with the fraud allegations

*** UPDATE, June 3, 2024 ***

ADLER Group’s financial situation continues to be difficult, especially as the current interest rate level represents an additional challenge for the entire industry – and thus also for ADLER Group. An agreement was recently reached with a group of bondholders on amendments to and the refinancing of certain existing financial liabilities, including the provision of additional liquidity, the partial subordination of bonds issued and the issue of so-called parts bénéficiaires (for details, see ADLER Group’s ad hoc disclosure dated May 24, 2024). However, further developments remain to be seen. Weisswert’s pilot lawsuit is no longer pending. We are also not currently seeking a test case. We also strongly advise shareholders not to join or file a lawsuit as long as the financial situation at ADLER Group does not improve significantly. Should the circumstances change, we will of course inform all investors who have registered with WEISSWERT about the options for action that we consider appropriate.

What has happened?

Adler Group S.A. (Adler) has been under criticism for months. The accusation made by market participants is of market and balance sheet manipulation. The price of the SDAX-listed Adler share has come under massive pressure as a result of several reports and accusations by short-sellers. Specifically, analysts from Viceroy Research LLC (Viceroy) accuse Adler Group S.A. of overvaluing real estate projects in order to manipulate balance sheets, make Adler Group S.A.’s value look better and raise more cash from investors.

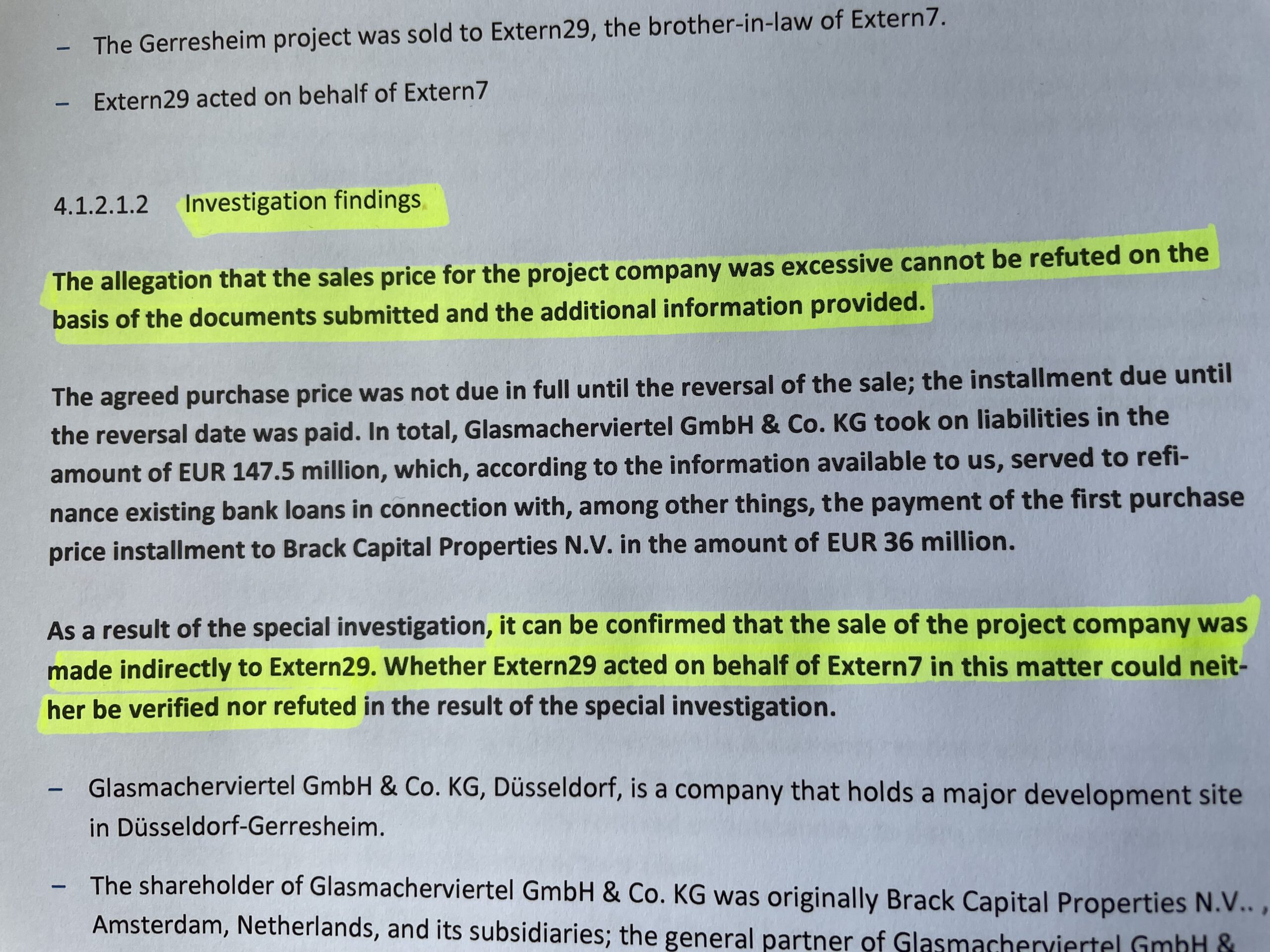

On a total of 101 pages in two dossiers dated October 6 and 12, 2021, Viceroy raised various allegations and also addressed specific real estate projects and related transactions, including dubious transactions in connection with Düsseldorf’s so-called Glasmacherviertel. Major shareholder Cevdet Caner is alleged to have arranged sales of properties at inflationary inflated prices with the help of his brother-in-law, so that Adler Group S.A. could achieve book profits and collect further money from investors by means of embellished figures. At the same time, the company is said to have been deprived of cash. The value of the real estate portfolio of €8.85 billion reported in the 2021 half-year report is said to be significantly inflated and does not reflect the true value.

Adler Group S.A. has fully denied the allegations. Due to the ongoing negative reporting, Adler finally commissioned a special investigation by KPMG Research with the aim of finally refuting the allegations, which Adler believes to be entirely unjustified. On January 28,2022 Adler announced by ad hoc announcement that the publication of the annual report, originally scheduled for March 31, 2022, would be postponed. Adler justified the postponement of the publication of the annual financial statements by stating that the investigation by KPMG Forensic was still ongoing and was not expected to be completed before the second quarter of 2022. The results of the special investigation, in turn, were a prerequisite for the final audit of the consolidated financial statements by the auditor KPMG Luxembourg. Finally, in February 2022 it became known that the German Federal Financial Supervisory Authority (BaFin) had initiated balance sheet control proceedings.

While the German financial watchdog’s investigations are ongoing (see current findings in the updates above), the KPMG report was published on April 22, 2022. According to this report, significant allegations could not be refuted. In addition, among other things, the fair value of all real estate projects examined on a sample basis as determined by KPMG is significantly lower than previously estimated by Adler.

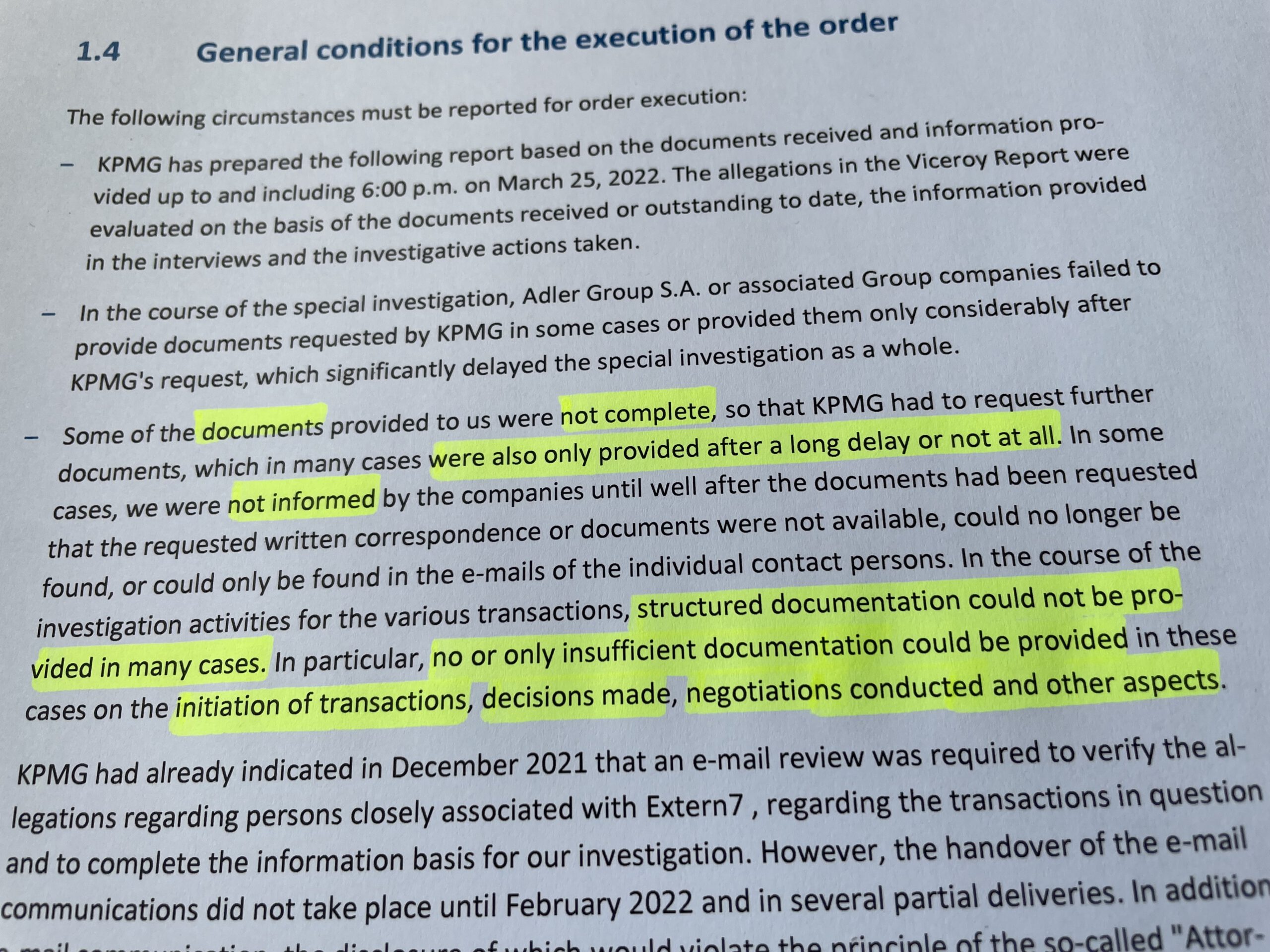

In addition, there was a significant lack of sufficient cooperation and documentation at Adler, which is why KPMG was unable to obtain a comprehensive picture of the situation. In the words of KPMG, it reads as follows:

Adler: Lack of documentation

Are shareholders and bondholders entitled to compensation?

In our firm opinion, shareholders and bondholders have claims for damages against the Adler Group based on the circumstances that have now become known. Following analysis of the KPMG report, we now consider the allegations made by Viceroy with regard to the valuation of the real estate portfolio to be partially true. In addition, significant allegations, for example with regard to the Düsseldorf Glasmacherviertel (see below), could not be refuted – despite the special investigation carried out by KPMG. Furthermore, on the basis of KPMG’s analysis, there are glaring deviations in value with regard to various real estate projects examined on a sample basis.

Adler Group: KPMG on the deal at Glasmacherviertel

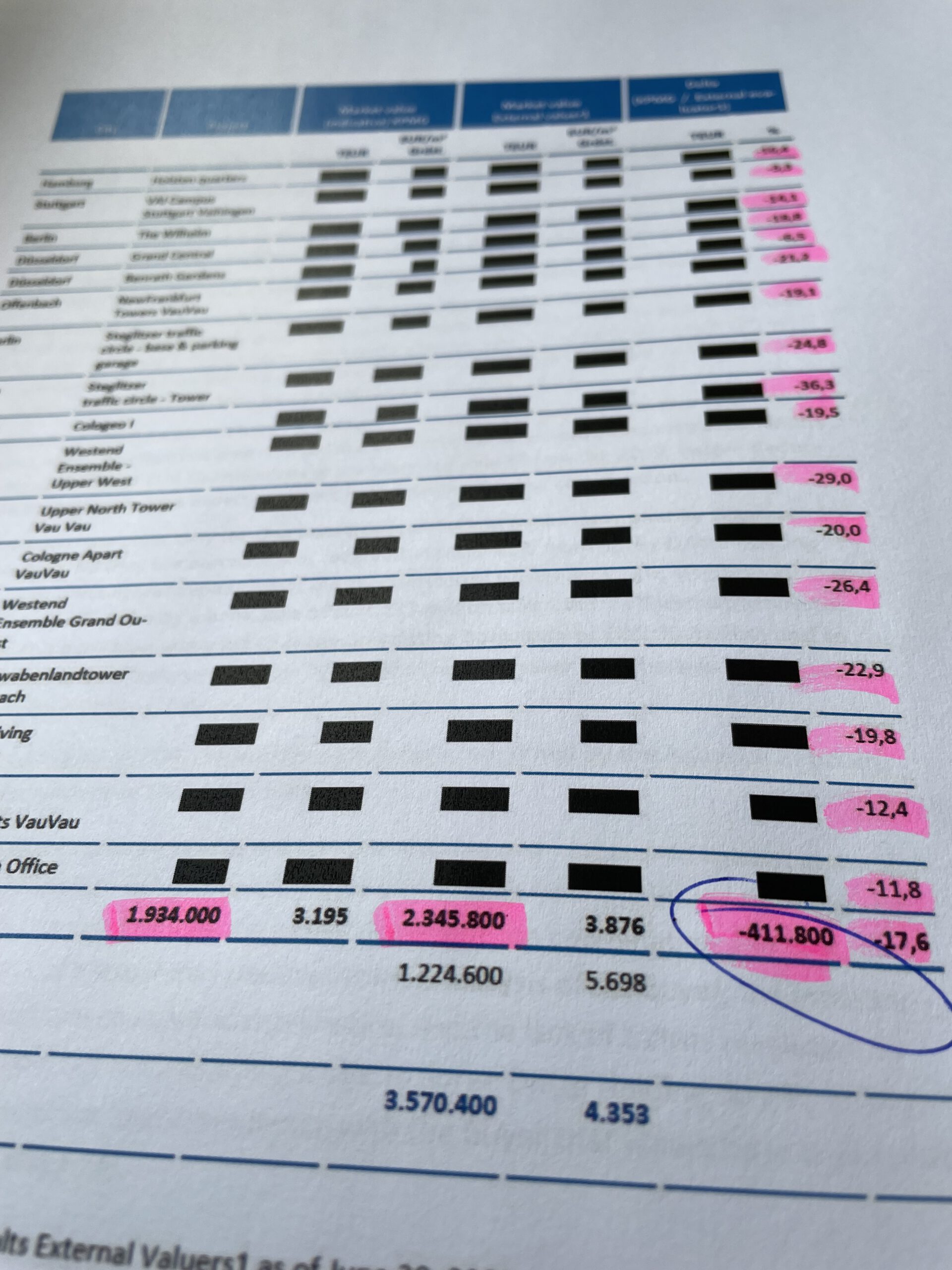

With regard to the real estate projects examined on a sample basis, KPMG consistently arrived at significantly lower fair value estimates than the external appraiser using the residual value method, namely an average of -17.6%, and at the peak (i.e., with regard to a single property) a decreased value of -36.3%. With regard to the sampled real estate projects alone, this results in a delta of 411.8 million euros(!) between the KPMG valuation and the original valuation.

Adler Group: KPMG estimates a delta of €411.8 million with regard to the valuation of Adler project developments

Furthermore, the value estimate made by KPMG is subject to further uncertainties because, according to KPMG, there is, among other things, no auditable documentation of the actual costs as of June 30, 2021 available. In addition, there were no detailed plans of the construction and ancillary construction costs. Against this background, KPMG unsurprisingly concluded that the financial performance of the Adler Group could not be conclusively assessed.

What can Adler investors do now?

We firmly believe that several circumstances constitute inside information. Pursuant to Art. 17 of the Market Abuse Regulation (MAR), issuers are obliged to publish inside information without undue delay. In our firm opinion, the Adler Group has not complied with this obligation and is hence liable to investors on the basis of sections 97, 98 of the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG).

Against this background, both shareholders and bondholders can assert claims for damages. In principle, investors can choose between two categories of damages, namely the so-called Kursdifferenzschaden (comparable to out-of-pocket damages) on the one hand and transaction damages on the other. While the transaction loss is easy to calculate (= difference between purchase and sale price), the out-of-pocket loss claculation is more sophisticated. The latter can exist even if you have a book profit. Against this background, you should have your claims examined with regard to both damage categories. In the case of the Kursdifferenzschaden, the question is by how many euros you bought the financial instruments at too high a price. The exact value depends not only on the respective purchase date, but also on whether you still hold the financial instruments or if have sold them in the meantime (and if so, when you did so).

Adler investors can register with WEISSWERT free of charge to receive a claim check. We will check for you free of charge whether and to what extent you have claims for damages. In addition, we will inform you about the costs as well as about the possibilities of financing legal costs.

The relevant financial instruments in the Adler case and their ISINs are as follows:

Stock

ADLER Group SA: LU1250154413

ADLER Real Estate AG: DE0005008007

Consus Real Estate AG: DE000A2DA414

Bonds

ADLER Group SA: XS1652965085, DE000A2RUD79, XS2010029663, XS2248826294, XS2283225477, XS2283224231, XS2336188029;

Adler Real Estate AG: XS1731858715, XS1713464441, XS1713464524;

Consus Real Estate AG: DE000A2GSGE2, E000A2G9H97;

Register now for your cost free review!

Explore your options and protect your rights. You can find out from WEISSWERT, free of charge, if you are eligible to claim compensation. If you have a claim, we will also provide you with our recommendation and with further available options on what measures can be taken. This service is free of charge.

headlines

FIND OUT MORE ABOUT OUR CURRENT CASES

With a pioneering spirit and highly focused expertise, we are passionate about effectively asserting the rights and protecting the assets of the investors and bank clients we represent.

Whatever we do, our goal is to achieve the best possible economic result for our clients, and to do so expeditiously and cost-effectively.

Maximilian Weiss, LL.M.

Attorney | Managing Director